10 Steps To Buying A Home In Winnipeg

|

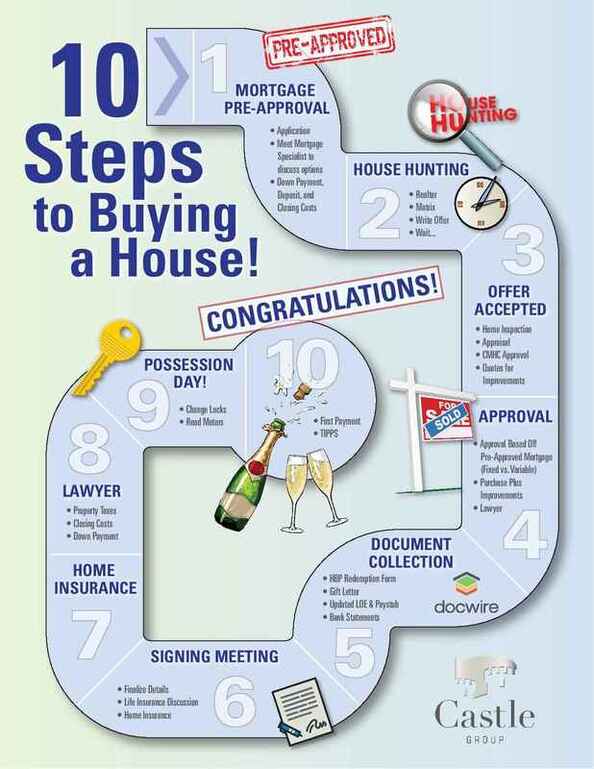

There are a lot of steps to buying a home and the process can get extremely stressful and overwhelming...especially if it's your first time purchasing a property.

The experience can be much more enjoyable if you know what to expect before you jump in. The map above outlines the typical steps involved and the descriptions below explain each step in detail. Step 1 - Mortgage Pre-ApprovalThe first, and most important step, is to figure out how much you're qualified to spend on a home. There's nothing worse than finding that perfect home and falling in love with it only to find out that you aren't qualified to purchase it.

Your best piece of mind is to get a proper pre-approval through a Mortgage Broker as opposed to a pre-qualification through a Bank or Credit Union. You can learn more about the pre-approval process and the difference between a pre-approval and pre-qualification by visiting the Mortgage Pre-Approval page on this website. Step 2 - House HuntingNow that you're fully qualified to buy a home, it's time to start shopping!

I always recommend working with a Realtor. A Realtors services are free to you, when you're buying a house, and their knowledge and expertise is invaluable. There are a lot of things to consider when choosing the right home to buy and a Realtor is trained to help you make the right choice and then negotiate the best deal on the home for you. |

If you don't know a Realtor that you feel comfortable working with, please contact me and I can recommend a great one for you!

Step 3 - Offer Accepted

When you find the perfect home to purchase, you'll write an offer to purchase and your Realtor will present the offer to the Realtor that is representing the seller. Along with the offer, you'll need to provide a deposit as consideration for the contract. Your Realtor will advise you as to what amount the deposit should be as it will depend on a few different factors.

It's important that you include something called a "finance condition" in your offer. A finance condition gives you time to arrange suitable financing for your purchase within a certain time frame. If, for some reason, there's an issue with financing, then you are able to back out of the purchase before the finance condition deadline and get your deposit back. If you didn't have a finance condition in your offer and needed to back out, you would have to forfeit your deposit. The finance condition is a safety net just in case something unexpected happens.

You may want to include other conditions in your offer as well, such as a home inspection or e a "subject to the sale" condition. A "subject to the sale" condition is if you need to sell your current home before you can purchase the new home. Again, your Realtor will guide you through the entire process.

The seller might accept your offer as is, or they may counter offer at which point your Realtor will guide you through the negotiation process.

When your offer is accepted by the seller, they will cash the deposit cheque you provided and that deposit will become part of your down payment.

It's important that you include something called a "finance condition" in your offer. A finance condition gives you time to arrange suitable financing for your purchase within a certain time frame. If, for some reason, there's an issue with financing, then you are able to back out of the purchase before the finance condition deadline and get your deposit back. If you didn't have a finance condition in your offer and needed to back out, you would have to forfeit your deposit. The finance condition is a safety net just in case something unexpected happens.

You may want to include other conditions in your offer as well, such as a home inspection or e a "subject to the sale" condition. A "subject to the sale" condition is if you need to sell your current home before you can purchase the new home. Again, your Realtor will guide you through the entire process.

The seller might accept your offer as is, or they may counter offer at which point your Realtor will guide you through the negotiation process.

When your offer is accepted by the seller, they will cash the deposit cheque you provided and that deposit will become part of your down payment.

Step 4 - Approval

Once your offer has been accepted by the seller, it's time to arrange the mortgage!

I will compare offers from dozens of different Banks, Credit Unions, Monoline and other types of Mortgage Lenders in order to find you the very best deal on your mortgage based on your needs.

Once I've found the Lender offering the best deal on your mortgage, I will submit your application to that Lender for review and approval.

The initial approval that I receive will be a conditional approval. This means that the Lender has approved the deal on a basic level but they still require a few more things in order to complete the approval.

I will compare offers from dozens of different Banks, Credit Unions, Monoline and other types of Mortgage Lenders in order to find you the very best deal on your mortgage based on your needs.

Once I've found the Lender offering the best deal on your mortgage, I will submit your application to that Lender for review and approval.

The initial approval that I receive will be a conditional approval. This means that the Lender has approved the deal on a basic level but they still require a few more things in order to complete the approval.

Step 5 - Document Collection

At this stage I will work with you to collect the remaining documents needed to complete your mortgage approval.

Depending on when your initial pre-approval was done, we may need to gather some updated banking information, paystubs and possibly a current employment letter.

If you will be taking advantage of any Government incentive programs or if your down payment will be coming as a gift from a family member, we will need the appropriate forms filled out for those situations.

The list of additional information shouldn't be too long at this stage.

Depending on when your initial pre-approval was done, we may need to gather some updated banking information, paystubs and possibly a current employment letter.

If you will be taking advantage of any Government incentive programs or if your down payment will be coming as a gift from a family member, we will need the appropriate forms filled out for those situations.

The list of additional information shouldn't be too long at this stage.

Step 6 - Signing Meeting

Once the mortgage is fully approved, we need to sign something called a Mortgage Commitment.

The Mortgage Commitment outlines the details of the mortgage contract including, mortgage amount, interest rate, term, amortization, payment amount, payment frequency, prepayment privileges, prepayment penalties and other important information.

I will go through the commitment with you to make sure you understand everything and answer any questions you have before you sign it.

**It's very important that you do not change your financial situation between this step and possession day. Mortgage Lenders reserve the right to check up on your financial situation just before they send the money to your lawyer to complete your mortgage and if they find that you've quit your job or racked up a bunch of debt, they have the right to refuse your mortgage.**

The Mortgage Commitment outlines the details of the mortgage contract including, mortgage amount, interest rate, term, amortization, payment amount, payment frequency, prepayment privileges, prepayment penalties and other important information.

I will go through the commitment with you to make sure you understand everything and answer any questions you have before you sign it.

**It's very important that you do not change your financial situation between this step and possession day. Mortgage Lenders reserve the right to check up on your financial situation just before they send the money to your lawyer to complete your mortgage and if they find that you've quit your job or racked up a bunch of debt, they have the right to refuse your mortgage.**

Step 7 - Home Insurance

You cannot have a mortgage without having insurance coverage for the home you're purchasing.

You'll need to arrange home insurance and have it in place before you take possession of your new home.

You will need to provide proof of insurance to your Real Estate Lawyer when you meet with them to sign the final paperwork to complete your purchase and take ownership of your new home.

I always recommend you use a Home Insurance Broker when purchasing home insurance as they will shop around to find you the best deal on your home insurance.

If you need a recommendation, I have an excellent Home Insurance Broker I can refer you to.

You'll need to arrange home insurance and have it in place before you take possession of your new home.

You will need to provide proof of insurance to your Real Estate Lawyer when you meet with them to sign the final paperwork to complete your purchase and take ownership of your new home.

I always recommend you use a Home Insurance Broker when purchasing home insurance as they will shop around to find you the best deal on your home insurance.

If you need a recommendation, I have an excellent Home Insurance Broker I can refer you to.

Step 8 - Lawyer

A few days before you take possession, you'll meet with the Real Estate Lawyer you've chosen to sign the final paperwork to complete your purchase.

Prior to meeting with the lawyer, they will send you a breakdown of the amount of money you'll need to bring to your meeting in order to complete your purchase. The funds they request will cover the remaining balance of your down payment as well as the closing costs associated with your transaction.

You will also need to provide the lawyer with proof that you have arranged home insurance.

I always recommend using a Lawyer who specializes in Real Estate. It will save you a lot of stress, and possibly money, by doing so.

If you need a recommendation, I have an excellent Real Estate Lawyer I can refer you to.

Prior to meeting with the lawyer, they will send you a breakdown of the amount of money you'll need to bring to your meeting in order to complete your purchase. The funds they request will cover the remaining balance of your down payment as well as the closing costs associated with your transaction.

You will also need to provide the lawyer with proof that you have arranged home insurance.

I always recommend using a Lawyer who specializes in Real Estate. It will save you a lot of stress, and possibly money, by doing so.

If you need a recommendation, I have an excellent Real Estate Lawyer I can refer you to.

Step 9 - Possession Day!

Finally the home is yours!

You can get the keys from your lawyers office and start moving in.

I highly recommend that you get the locks changed on all the exterior doors of the home because you never know who has a key. You don't necessarily need to replace the entire lock mechanism, as long as the locks are still in good condition, you can have a locksmith re-key the existing locks to save you some money.

Also on possession day, you'll need to walk through the house and make sure that everything is the way it should be according to the offer you made to the seller and also make sure everything works. If you find that something is wrong, be sure to call your Lawyer ASAP and let them know. They will guide you from there.

You will also need to take call all the necessary utility companies and set up accounts and take current meter readings for them.

You can get the keys from your lawyers office and start moving in.

I highly recommend that you get the locks changed on all the exterior doors of the home because you never know who has a key. You don't necessarily need to replace the entire lock mechanism, as long as the locks are still in good condition, you can have a locksmith re-key the existing locks to save you some money.

Also on possession day, you'll need to walk through the house and make sure that everything is the way it should be according to the offer you made to the seller and also make sure everything works. If you find that something is wrong, be sure to call your Lawyer ASAP and let them know. They will guide you from there.

You will also need to take call all the necessary utility companies and set up accounts and take current meter readings for them.

Step 10 - Congratulations

It's time to celebrate...but don't go too crazy because you've got mortgage payments to make now!

Make note of when your first mortgage payment will be coming out of your account and be sure to have enough funds ready. Don't be shocked if your first mortgage payment is delayed a day or two...it happens sometimes depending on how long it takes everything to get set up on the Lenders side of things.

Enjoy your new home and remember that myself, your Realtor, your Lawyer, and your Home Insurance Broker are always available if you need have any questions or need anything at all.

Make note of when your first mortgage payment will be coming out of your account and be sure to have enough funds ready. Don't be shocked if your first mortgage payment is delayed a day or two...it happens sometimes depending on how long it takes everything to get set up on the Lenders side of things.

Enjoy your new home and remember that myself, your Realtor, your Lawyer, and your Home Insurance Broker are always available if you need have any questions or need anything at all.